Covid-19 Barometer: Financial uncertainty outweighs health concerns

Financial concerns are the number one worry

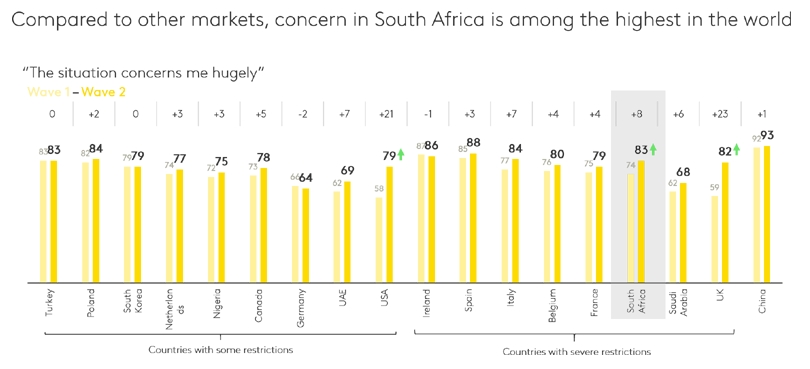

All around the world, overall levels of concern are intensifying as the pandemic progresses. But it is financial concerns that outweigh personal health concerns at this stage of the crisis. At least 68% of people say the situation demands more proactive financial planning, and 60% are worried about the economy’s ability to recover, while only 50% of people are concerned about falling sick.

The financial concern is driven by the very real impact Covid-19 is having on household incomes. At least 71% of people surveyed globally say that their household income has or will be impacted by the coronavirus. This rises to 78% amongst millennials, who are more likely to work in positions or industries that are at risk.

News consumption is up, as people seek to stay informed

Being prepared and keeping well informed is the primary response across markets, seen as paramount by more than a third of respondents globally (34%). National media channels, such as national TV channels and newspapers, are still seen as one of the most trusted sources of information, with 54% of people identifying them as a trustworthy source.

Audience measurement data collected by Kantar has recorded significant viewer increases in new outlets around the world:

- In China, the time spent watching news programmes has more than doubled in the first three months of the year, from nine hours in 2019 to 18.5 hours in 2020.

- In the UK, 17 out of the 20 most-watched shows in 2020 have been BBC News.

- In Brazil, the share of time spent watching the news has increased by a third through the month of March.

Trust in government websites has increased to 54%, vs 48% during wave one of the research, suggesting that as the severity of the pandemic increases, people are increasingly looking to their government for information and support.

Those most affected see this is an opportunity to reset

Young adults are more likely to be feeling the financial impact of the coronavirus and are experiencing the most change to their day-to-day lives. Many are making healthier lifestyle choices, as people look to take control of what they can. At least 59% of 18-34s say they are eating healthier, 57% are using this as an opportunity, and 48% claim to be exercising more regularly.

We are also seeing more change and experimentation from this age group; 44% are using the time to focus on personal development, and 25% are choosing to meditate.

Are you adopting healthier habits as a result of #COVID19? ����♀️⭐️ #lifeunderlockdown https://t.co/k137Kj4mdI

— Kantar Africa & Middle East (@Kantar_AME) April 20, 2020

Consumers increasingly expect companies to ‘step up’

Data from the first wave of the Covid-19 Barometer research found that people expect businesses to prioritise staff welfare and to play their part in supporting society through the pandemic. Analysis of data from the second wave suggests the public role for companies is accelerating, as people expect practical help from companies, including the donation of useful items and helping the government. At least 47% of people now expect companies to support hospitals during the crisis (vs 41% in wave one), while 39% say that companies should be making themselves available to governments (35% in wave one).

Like companies, brands are also in the public eye – and are expected to be practical, realistic and helpful. At least 31% of people want brands to help them during their everyday life, suggesting that how brands behave now will be remembered in life after the pandemic.

What brands should do now, for best results post-pandemic #employeesfirst ⚕️ https://t.co/BBJfGIEQIx

— Kantar Africa & Middle East (@Kantar_AME) April 21, 2020

We need those reminders because this certainly is a time of business as unusual.

Business transformation, not as you know it

A late March/early April Harvard Business School survey of small businesses in the US, where the working definition is firms with under 500 employees, but the vast majority have under 10, reveals that most firms will simply not survive current lockdown conditions.

The chart showing the percentage that think they can survive each time period shown for one month, four months and six months, is just a fraction of the percentage. Even at one month, about one-third of all these businesses are gone and, beyond that, well over half. So, forget consumers, as the so-called new normal is going to be defined by business transformation. Get used to it now: Your favourite little shop is probably not going to make it.

Biz Impact Survey reveals true effects of the pandemic on South African businesses

Locally, Amien Ahmed, director, public division, Kantar South Africa comments: “It’s very clear that SA businesses are under extreme pressure, with the financial impact on business proving to be as tough as managing the virus itself. Will SA businesses be able to recover and how long will it take before it’s business as usual? Our survey shows that there is not a large margin to buffer the effects of Covid-19 for much longer.”

Interim results from Kantar South Africa’s Biz Impact Survey among 480 small, medium and large businesses in South Africa, from 8 April to date, also reveal the following:

- 44% of business owners say that if current restrictions continue, their business would not be able to continue operating for longer than three months.

- Nine out of 10 SA businesses say they have been affected by Covid-19.

- The three biggest concerns are financial impact; fear of a potential global recession; and reduced consumption.

- Eight out of 10 businesses say Covid-19 will decrease revenue or profitability.

- Many discretionary expenses are already on the chopping board.

- The rise in remote work has required costly investment in hardware and data enablement.

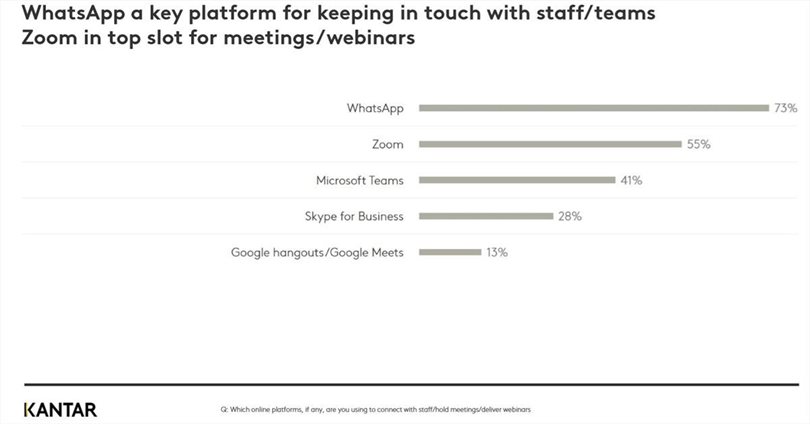

- WhatsApp has become a key platform for keeping in touch with staff/teams, while Zoom in the top slot for meetings/webinars.

Add your voice to the final findings of our Biz Impact Survey by clicking here to take part. Contact Amien Ahmed, director, public division, Kantar South Africa for more information on moc.ratnak@demha.neima.

Stock up on further updates and insights to help your brand manage the effects of COVID-19 and prepare for the future on our Covid-19 page. Follow us on Kantar LinkedIn and Twitter to keep up to date with our comms, and stay safe!

- Diary of a CMO: How can I protect my brand against copycats? 18 Feb 2025

- What makes or breaks a product launch? 11 Feb 2025

- GenAI in marketing: Fear or FOMO? 30 Jan 2025

- Diary of a CMO: Is your category’s ceiling coming down on you? 28 Jan 2025

- 3 questions to identify your brand’s strategic priorities for 2025 5 Dec 2024

KantarKantar is the world's leading evidence-based insights and consulting company. We have a complete, unique and rounded understanding of how people think, feel and act; globally and locally in over 90 markets. By combining the deep expertise of our people, our data resources and benchmarks, our innovative analytics and technology we help our clients understand people and inspire growth. |