Growth markets survey 2013 - Kenya country report

It's no secret that Africa is an exciting place to be involved in the mobile industry. Contributing 3.5% towards to continent's total GDP and home to some of the world's fastest growing economies, the African mobile market is forecast to quadruple in seven years, growing from a combined value of US$60 billion in 2013 to around US$245 billion in 2020.

Despite the impressive growth and countless innovations coming out of Africa, barriers to market entry still exist. Challenges for those navigating the various regulatory environments and infrastructural issues, amongst others, are often cited as obstacles.

MEF Africa teamed up with local member KPMG to take a deep dive into business confidence, opportunities and challenges for mobile content and commerce in Africa.

This is the executive summary for the Kenya country report, which was supported by Nation Media Group. Standalone reports on South Africa and Nigeria will be released in the near future as well as comparative analyses between the countries.

MEF Africa's three-country study provides an industry snapshot on today and tomorrow's mobile content and commerce landscape. It delivers independent insight that can help both mobile specialists and those who are new to mobile to develop targeted mobile strategies and fully exploit the rich opportunities that mobile provides.

Key Findings

- Optimism

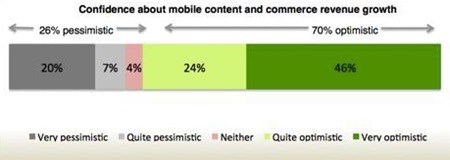

Key findings showed an optimism of Kenyan industry leaders towards mobile content and commerce revenue growth after a third of respondents saw mobile end-user revenues rise more than they expected last year.

- Mobile money and m-payments lead the way

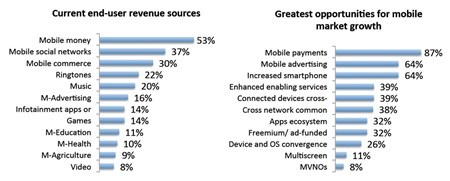

Perhaps unsurprisingly in a market with highly developed mobile money and m-banking offerings, mobile money was found to be the main source of end-user revenue followed by social networks and mobile commerce.

The results also revealed that Mobile payments are considered by far the greatest opportunity for market growth followed by advertising and rising smartphone adoption.

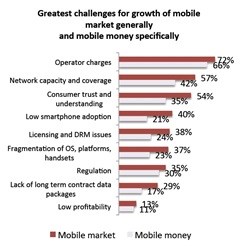

- Challenges with operators and lack of consumer education still present problems

Whilst opportunities in the mobile industry abound, business leaders cited that the main challenges lie with the operators, particularly with regards to high charges and network issues. Providing a clear call to action to the industry respondents believed that more should be done to educate and reassure consumers and whilst rising smartphone adoption is one of the greatest opportunities, fragmentation issues are still key challenges.

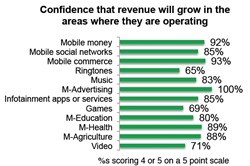

- Confidence for traditional downloadable content is in decline

The report demonstrates that organisations with ringtones, games and video as one of their main sources of revenue are least confident about their growth whereas those with most of their revenue from m-advertising are supremely confident about growth.